Mortgage Deduction Limit 2024

Mortgage Deduction Limit 2024. Are home mortgage interest payments tax deductible? Under the tcja, homeowners can deduct mortgage interest on up to $750,000 of qualified residence loans ($375,000 for married individuals filing separately).

Under the tcja, homeowners can deduct mortgage interest on up to $750,000 of qualified residence loans ($375,000 for married individuals filing separately). This article aims to provide a comprehensive answer by diving into the concept of itemized deductions, an overview of the mortgage interest deduction, the changes in tax laws.

This Limit Is $10,000 For Single Filers And Married Couples Filing Jointly, And $5,000 For Married Couples Filing Separately.

A $3,500 basic pensionable earning is exempt from the deduction.

Standard Deductions For Single, Married And Head Of Household.

The mortgage servicer during the tax year.

28, 2023, The Federal Housing Finance Agency (Fhfa).

Images References :

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction The Official Blog of, The current maximum mortgage interest deduction is based on a $750,000 mortgage amount. This actively caps the amount you can deduct from your taxable income, ensuring a revised mortgage.

Source: mortgageservicesce.com

Source: mortgageservicesce.com

Calculate Mortgage Interest Deduction Limit?, No hike in home loan interest deduction limit in interim budget 2024. If you are married and filing jointly or file as a qualifying widow (er), your 2023.

Source: sariabodbr.blogspot.com

Source: sariabodbr.blogspot.com

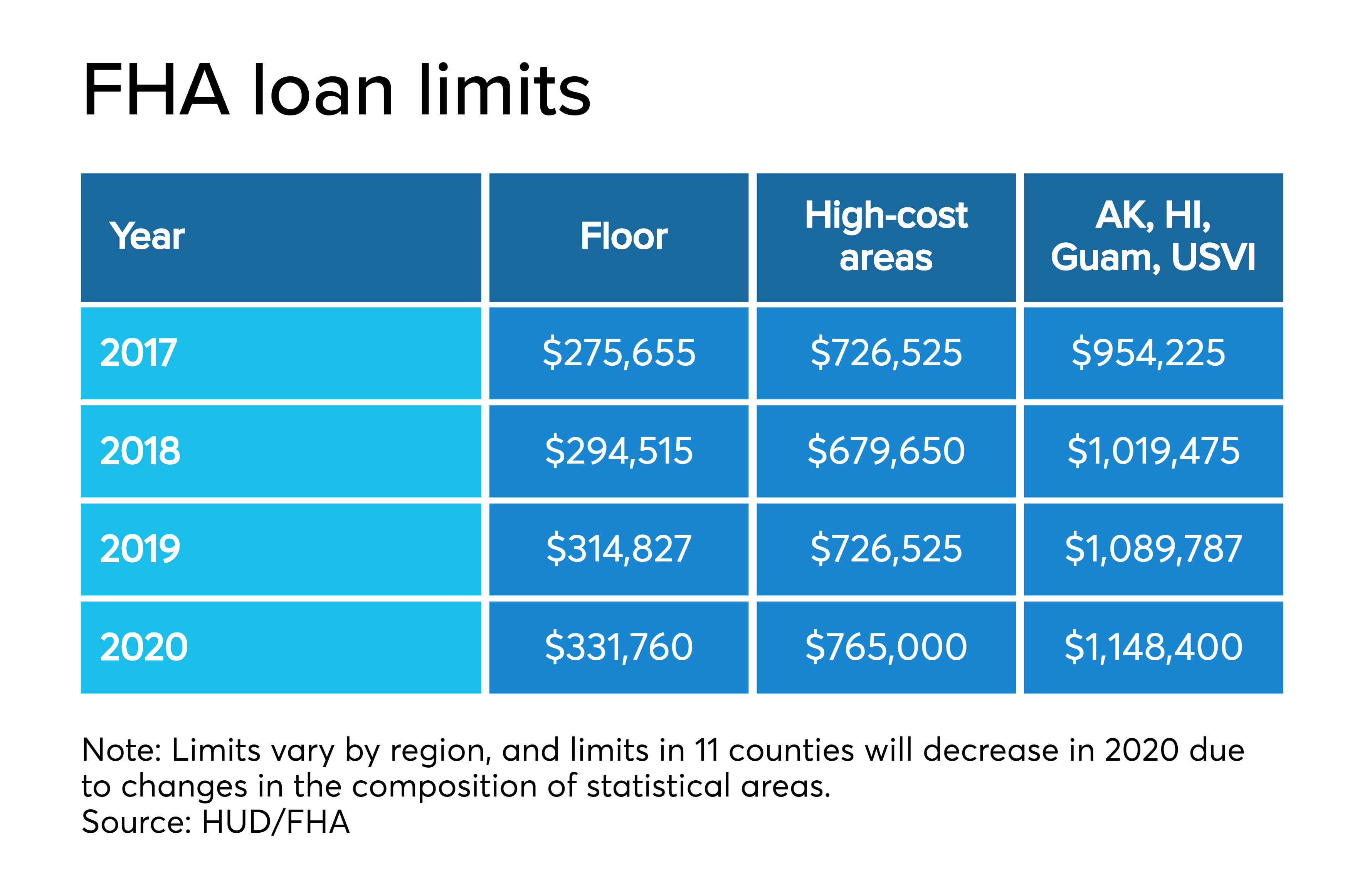

Fha Loan Limits, Standard deductions for single, married and head of household. For the 2024 tax year, married couples filing jointly, single filers and heads of households can deduct up to $750,000.

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction With TaxSlayer, When the tax reform act of 1986, p.l. The current maximum mortgage interest deduction is based on a $750,000 mortgage amount.

Source: pricemortgage.com

Source: pricemortgage.com

2024 Conventional Loan Limits Price Mortgage, Are home mortgage interest payments tax deductible? So, the 2023 limit for this deduction is $750,000.

Source: www.taxesforexpats.com

Source: www.taxesforexpats.com

Mortgage Interest Deduction Guide 2024 US Expat Tax Service, This means that if you pay more than. The limit applies to both new and existing.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, (salt) deduction, which was capped at $10,000, and caps on. Any amount you earn above $3,500 up to $68,500 (maximum annual pensionable earnings.

Source: www.rate.com

Source: www.rate.com

Demystifying the mortgage interest deduction Guaranteed Rate, When the tax reform act of 1986, p.l. A silver lining from high mortgage interest rates:.

Source: www.pinterest.com

Source: www.pinterest.com

How the Mortgage Tax Deduction Works FREEandCLEAR Mortgage process, A silver lining from high mortgage interest rates: Before the tax cuts and jobs act (tcja) passed in december 2017,.

Source: myameriflex.com

Source: myameriflex.com

IRS Announces 2023 Contribution Limits for HSAs Ameriflex, This limit is $10,000 for single filers and married couples filing jointly, and $5,000 for married couples filing separately. For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers.

Before The Tax Cuts And Jobs Act (Tcja) Passed In December 2017,.

When the tax reform act of 1986, p.l.

For The 2024 Tax Year, Married Couples Filing Jointly, Single Filers And Heads Of Households Can Deduct Up To $750,000.

The limit applies to both new and existing.